“Risks and opportunities in the cryptocurrency trade: attraction of the big book, exchange rate risk and arbitration strategy”

While the cryptocurrency market continues to develop and mature, traders are looking for more and more means of increasing yield while reducing losses. One of the most important risks associated with the cryptocurrency trade is the risk of exchange rate. When cryptocurrencies have negotiated at different rates on different scholarships, this can cause significant losses if you buy low and sell high.

In order to reduce this risk, traders must be aware of a number of key concepts, including major book technology, exchange risks and arbitration strategies. The big book is an essential element of the cryptocurrency ecosystem, allowing users to store, manage and transfer their assets in a safe and transparent manner. Using advanced major book solutions, such as the Ethereum intelligent contract platform or the Binance intelligent chain, traders can obtain competitive advantages.

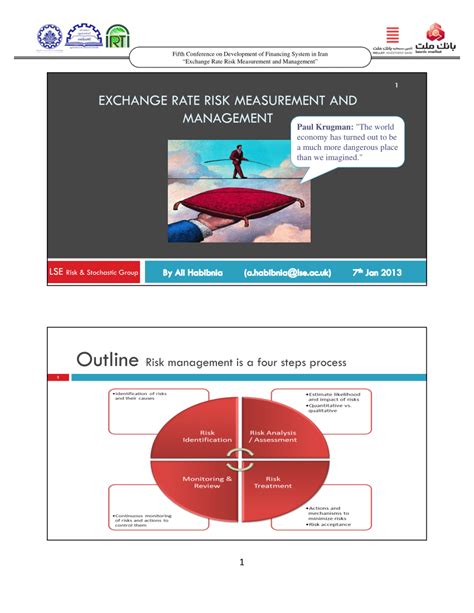

The risk of exchange rates refers to the difference between the price of cryptocurrency in an exchange and its price in another exchange. In trade with the cryptocurrency trade on different scholarships, you can face significant price differences in factors such as costs, liquidity and volatility of the market. In order to manage the risk of exchange rate, traders must be aware of their purchasing and sales strategies and adjust them accordingly.

Arbitration strategies include the use of price differences between two or more markets to benefit from differences. Using arbitration platforms such as Crypto.com or Binance’s Liquidity Pool, traders can access better prices for their cryptocurrencies and increase their performance.

On the rapidly growing cryptographic market today, traders must be highly customizable and meet changing market conditions. An effective way to do so is to use major book technology, the exchange rate risk management strategy and the combination of arbitration methods. Including the risks linked to the trade in cryptocurrencies and attracting advanced solutions, traders can obtain significant advantages to their investment decisions.

Main techniques:

- Great book technology is an essential element of the cryptocurrency ecosystem

- The risk of exchange rate refers to the difference between the prices of the various scholarships

- Arbitration strategies include the use of price differences for market differences

- Great book technology, exchange rate management and arbitration methods can help traders maximize their performance and reduce losses

Best practices:

- Do an in -depth control of research and reliability before any trading strategy

- Monitor market conditions and adjust your strategy accordingly

- Attract the main large book solutions to obtain competitive advantages

- Be aware of the development of regulatory implementation and market changes that can affect your investment decisions

By following these tips and including the technology of the big book, the concepts of exchange rate management and arbitration strategies in the commercial approach can considerably reduce the risk of exposure and maximize return to the cryptographic market.